The challenges in Family Business usually arise when the business and family have grown to include participants beyond the founder and his original supporters. Often at the founding stage of the business, the owner personally directs all employees and there is seldom, if ever, any middle management. There are no additional shareholders and next generation members are yet to become involved in the company. Lack of capital—financial and human—may forestall growth. Should the business stay in this mode, it is likely to remain a one man show and follow the founder to his/her grave. There are owners who intend for the business to take that exact course, in which case the firm has fulfilled its purpose.

It is more likely though that the business begins to outstrip the founder’s initial vision and while the growth may well be uncharted, it is exciting and gratifying to the owner. Business functions evolve into departments that require professional management. Bankers and other financiers line up to fund the expansion. The founder begins to see unlimited possibilities and he is anxious that some, if not all of his children, come on board to help him steer the ship. The business prospers and the family flourishes—a founder’s vision and his ultimate challenge. He must move beyond being both pilot and crews man and leave behind the “chief cook and bottle washer” approach. He must learn to lead as well as manage the demands of the growing business and the expanding family. There are some who are not able to make this transition and again, the business meets its demise with that of the founder or is sold off to another family business or conglomerate. This is a tragedy for me to witness when I know that the founder and his family really desired the longevity of the firm as their family business. The pain is compounded when the end result is also discord and distance among family members.

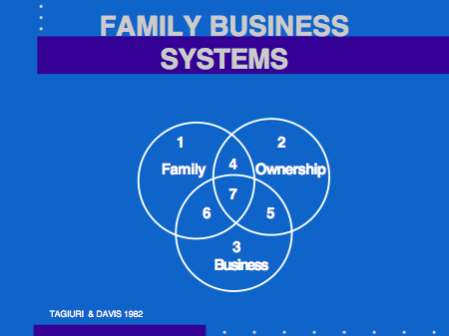

FBs have several constituencies all of which carry their own peculiarities and demands. When the field of Family Business Management began to receive more attention as a subset of management, two scholars in the field devised a simple and elegant model to represent the stakeholders in a FB. The diagram included on this page shows 3 intersecting circles—labelled family, ownership and business with 7 distinct sectors. Sector 1 includes those family members who are not shareholders or at least not yet shareholders. Here we find the spouses of the Sibling Partnership who wonder aloud that their spouse works longer and harder hours than the other siblings but makes the same money. The sector labelled 2 represents owners who are not family members and who do not work in the business. While I have encountered some Caribbean FBs which count as shareholders the founder’s friends who perhaps had invested originally in the business, this is mostly an empty segment. By the time the business has moved into subsequent generations, these minority shareholders have been bought out.

The area labelled 3 contains non-family employees who step gingerly around the brawling brothers in the office. Regrettably some of these talented professionals walk right out the door to a competitor where they hope family issues do not intrude into the business. Subdivision number 4 are family members who have shares in the business but do not work in the business—the medical doctor to whom Dad left some shares and who cannot understand why those shares pay no dividends even as her sister who works in the business lives the high life. These passive shareholders, as they are termed, are usually very unhappy about the lack of information they receive about the business and are eager to give their input, if only someone would listen. Section 5 covers those owners who work in the business but are not family members—again a subdivision with a limited population among those FBs I see. Slice number 6 are family members who work in the business but are not owners or even potential owners—the great niece of the founder’s wife. FBs hire them thinking that they will seek the interest of the owners and have no idea how to deal with their chronic late coming or under performance. And I like to say that the inhabitants of sector 7 get to have all the fun—work nonstop in the business, have to answer the questioning if not irate phone calls of passive shareholders and deal with the fears of non family employees who see glass ceilings everywhere they look.

There is a way though to make the job more fun and infinitely more rewarding than driving the latest model luxury car. A wildly successful business and harmony in the family –a dream come true and within the grasp of any business owner. It takes commitment to process, willingness to engage, fostering of a common focus –skills that may well be at odds with those of the entrepreneurial founder but necessary for the growth and governance of a Family Business. Family Business governance is different from corporate governance, even as it includes elements of the latter.